News

KUBS News

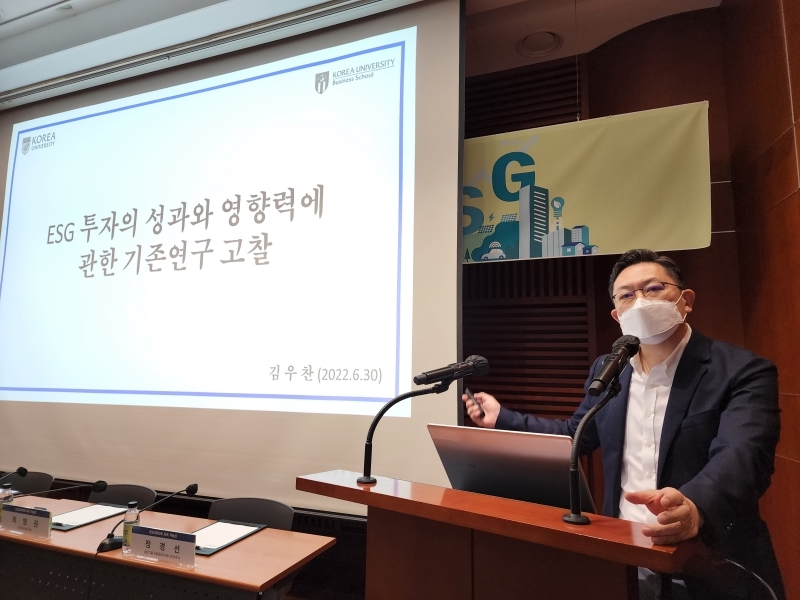

The AICG-KCMI Joint Symposium co-hosted by the Asian Institute of Corporate Governance (Director = Park Kyung Suh) and the Korea Capital Market Institute (Head = Shin Jin Young) was held on the topic of "Sustainability of ESG Investment." The symposium, held at the Yeouido Financial Investment Center on June 30th, held various discussions on the "Sustainability of ESG investment returns," which are the main background of ESG (Environmental, Social, and Governance) management.

Starting with the opening speeches of Park Kyung Suh, Director of AICG and Shin Jin Young, Head of KCMI, Hwang Sunwoo, professor from KUBS, hosted the main event. In the presentation, each speaker gave a presentation under the theme of △Kim Woochan, professor from KUBS, "A Study on the Performance and Influence of E&S Investment” △ Nam Jaewoo, a researcher at KCMI, “ESG Investment and Profitability of Public Pension Fund” △ Na Hyun Seung, professor from KUBS, “ESG management and stock price returns of domestic companies.”

Professor Kim Woochan of Korea University said, "Investment in the E&S Engagement method will also realize a positive (+) excess return in the future through ‘Study on the Performance and Influence of E&S Investment (investment considering environmental and social value factors).’” In addition, once capital market participants efficiently reflect E&S information in stock prices and fully recognize the gravity of the E&S problem, investment in selective E&S method will be revealed as a negative excess return and investment in the E&S integration method will be zero excess return. In addition, it was diagnosed that the E&S engagement method will be effective in improving the E&S performance of the investment target company, but the selective E&S method and the integration method will not be effective.

Nam Jaewoo, a researcher from KCMI, said, "The driving force behind domestic ESG investment is the public pension fund, including the National Pension Service." In addition, it was emphasized that the fiduciary duty for pension subscribers can be recognized only if the long-term stability and sustainability of the return on investment are improved from a financial perspective.

Professor Na Hyun Seung of Korea University analyzed the impact of corporate ESG management on stock price returns in the face of an economic crisis in which asset value changes rapidly due to the COVID-19 virus. Although the cross-sectional analysis results differ depending on the control variables used, it was found that if corporate characteristics before the COVID-19 were controlled using panel regression and double difference method, stock price returns increases compared to the previous period as ESG evaluation, especially the Enviormental(E) evaluation, os better. Through this, a positive empirical basis for the impact of ESG on shareholder value was presented.

After the presentation session, Lee Inhyung, a member of KCMI, continued a panel discussion involving academic experts. △Yeo Eunjung (Professor of Chung-Ang University) △Lee Dongseop (Director of the National Pension Service Investment Management Trustee's Responsibility Office) △Jung Kyungsun (Co-founder/managing partner of Sylvan Group) △Choi Youngkwon (CEO of Woori Asset Management) participated as debaters.