News

KUBS News

"Creating the Company’s Unique Entry Barrier is Important" ... Entrepreneurship Special Lect

2024.05.07 Views 2323 국제실

"Creating the Company’s Unique Entry Barrier is Important" ... Entrepreneurship Special Lecture by Yoon Sungpil, CFO of Thingsflow

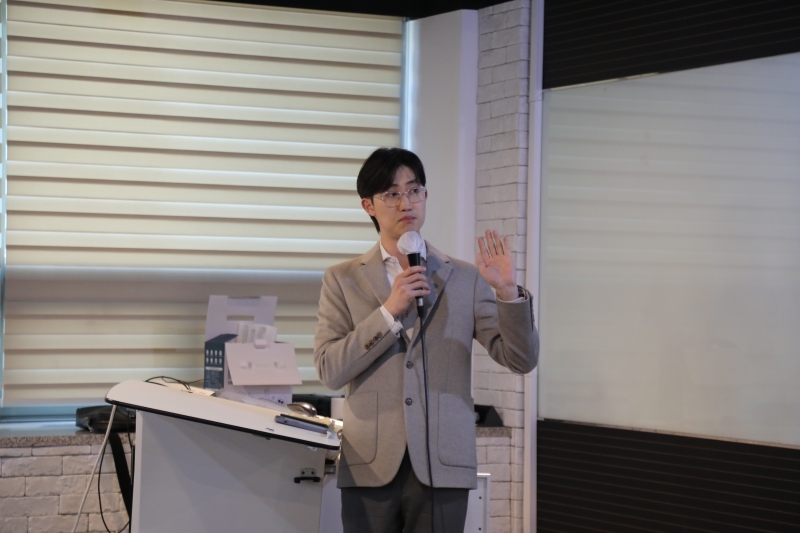

On April 9th, the first semester of the Entrepreneurship Academy was held at the KUBS (Dean = Kim Sang Yong) Startup Research Institute (Director = Moon Jungbin). Yoon Sungpil, CFO of Thingsflow, was the speaker for the first lecture series of the Entrepreneurship Academy. CFO Yoon Sungpil spoke on the topic of 'VC and the Startup Market,' providing explanations and advice on initial startup funding.

CFO Yoon Sungpil built his career as a venture capital (VC) expert, having worked as the head of the Shinhan Venture Investment Team, a reviewer at Neoflux, and an investment analyst at NHN Investment. Currently, he serves as the CFO of Thingsflow, a company that produces B2C services utilizing AI technology, such as 'Hellobot' and 'Between.'

Firstly, CFO Yoon Sungpil explained the methods of startup funding. Startup funding is divided into stages of growth such as △seed investment, △Series A, B, C, and △accelerator funding. CFO Yoon said, "Many startups face the most difficulties in the seed and Series A stages," and "since there is not much evidence to show, investments close to trust tend to occur."

CFO Yoon then described the characteristics of startups that VCs want to invest in. Firstly, there are types of startups that are easy to invest in, such as △tech companies, △online companies, and △new businesses. CFO Yoon explained, "Companies with technological expertise can undertake unique ventures, thus receiving high evaluations in terms of stability and growth potential," and "VCs also favor types of businesses such as online businesses, software, and content, which can scale up easily and make a significant impact with minimal investment.”

CFO Yoon also introduced the perspective of VCs in evaluating startups. Firstly, the potential market size that the startup can enter and its growth potential are considered. CFO Yoon emphasized, "Before starting a business, one should question whether the item can create a large market," and "targeting a market with a size of at least 1 trillion and rapid growth is advisable."

Secondly, the importance of the problem is the market defined by the company is considered. CFO Yoon said, "It is important to consider whether the problem is one that customers really want to solve," and "There is also a way to enter an existing market where demand already exists."

Thirdly, the uniqueness of the technology possessed is considered. CFO Yoon introduced the case of the startup 'Ppodeuk,' which provides dishwashing services, as an example. CFO Yoon explained, "While it may seem like a problem difficult to solve in student entrepreneurship, even small entry barriers can be created," and "By mastering the dishwashing process itself over several years, 'Ppodeuk' has created its entry barrier." He further elaborated, "Although it's an idea anyone could think of, by diligently understanding customer needs, the product itself can become a unique entry barrier for the company," emphasizing how understanding customer needs persistently can turn the product into the company's unique entry barrier."

Fourthly, the upper limit of the price at which the product can be sold is considered. CFO Yoon emphasized, "How expensive the product can be sold for, is equivalent to proving the influence of the business," and "Attracting customers by lowering the price is not a scalable method," advising to think about maintaining the price but creating added value corresponding to the price.

Lastly, the position of the team within the market and the qualities of the team members are considered. CFO Yoon explained, "When a good team is established, the approach to conquer the market itself changes," and "Since the team itself can be a selling point, it is important to create a startup that gathers the best talented people."

The lecture concluded with a Q&A session. CFO Yoon advised, "It is important to meet as many VC-related individuals as possible from the early stages," and "there is a need to consider the dilemma between efficiency and stability in fundraising as well."