News

KUBS News

AICG Distinguished Speaker Series, A Question about Short-Termism: What Is the Real Problem?

2025.08.06 Views 1676 국제실

AICG Distinguished Speaker Series, A Question about Short-Termism: What Is the Real Problem?

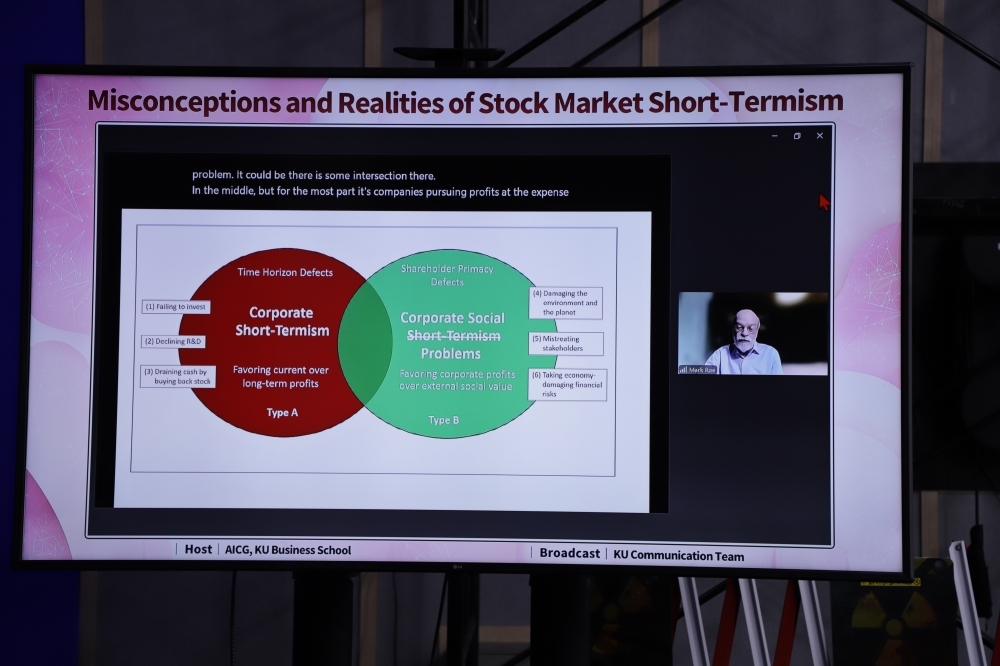

Korea University’s Asian Institute of Corporate Governance (AICG) hosted an online seminar on Thursday, July 3, as part of its ‘Distinguished Speaker Series,’, featuring Professor Mark J. Roe, a world-renowned scholar in corporate law from Harvard Law School. The seminar was held under the theme, “Misconceptions and Realities of Stock Market Short-Termism.”

The event proceeded as follows: △ From 4:00 p.m. to 4:05 p.m., Professor Joon Ho Hwang of Korea University Business School served as the moderator, delivering a welcome address and introducing the speaker. △ From 4:05 p.m. to 4:40 p.m., Professor Mark J. Roe delivered the keynote presentation. △ From 4:40 p.m. to 5:40 p.m., a panel discussion was held, moderated by Professor Hwang, featuring Professors Woochan Kim and Ji-Woong Chung of Korea University Business School, Namuh Rhee, Chairman of the Korea Corporate Governance Forum, and Hyung-kyoon Kim, Executive Director of TCHA Partners Asset Management.

In his welcoming remarks, Professor Joon Ho Hwang stated, “I hope today’s seminar will move beyond the conventional understanding of stock market short-termism and serve as a platform for reflecting on a more balanced perspective and long-term vision.” He continued, “Today’s speaker, Professor Mark J. Roe, is a globally renowned authority in the fields of corporate law and governance. I believe his insights will offer meaningful implications for the Korean corporate landscape as well.”

Professor Mark J. Roe delivered his lecture based on his recently published book, 『Missing the Target: Why Stock Market Short-Termism Is Not the Problem』(Oxford, 2022). He argued that short-termism is an often exaggerated phenomenon, and that the notion of the stock market as the primary cause of reduced long-term corporate investment is overly simplistic. Instead, he explained that structural factors—such as the rapid pace of technological change, policy uncertainty, and intensified global competition —play a more significant influence in shaping corporate investment decisions.

In particular, Professor Roe remarked, “If stock prices were solely by short-term earnings, then during the pandemic—when corporate profits sharply declined—stock prices should have fallen. However, in reality, the share prices of many companies increased.” He presented empirical evidence to support the view that the stock market does, in fact, incorporate long-term outlooks. He further warned that the short-termism narrative could be exploited by certain stakeholders to defect responsibility and justify misguided policy decisions, stressing that focusing solely on short-termism cannot provide a meaningful solution.

During the panel discussion, there was a shared view that although concerns about short-term performance pressure are prevalent in the Korean business community, the fundamental problem lies in controlling shareholders’ pursuit of private benefits and their avoidance of responsibility. It was also noted that activist funds, rather than simply seeking short-term profits, can contribute positively by enhancing the efficiency of capital allocation and reallocating underutilized or inefficient assets. Participants further emphasized the need to reform executive compensation systems, shifting the focus from short-term financial outcomes to long-term performance-based incentives.

Concluding his lecture, Professor Roe emphasized, “To achieve sustainable growth, both companies and society must move beyond the simplistic narrative that places sole blame on short-termism and instead respond to fundamental structural changes.”

The seminar served as a valuable opportunity to re-examine traditional interpretations of short-termism, urging corporations, investors, and policymakers to adopt a more balanced perspective and long-term vision.