News

KUBS News

Business Analytics Major ‘BA_IDEA’ Team Wins the President’s Award from the KFTC Institute

2025.12.29 Views 904 국제실

Business Analytics Major ‘BA_IDEA’ Team Wins the President’s Award from

the Korea Financial Telecommunications & Clearings Institute at the 2025 FSC D-Testbed

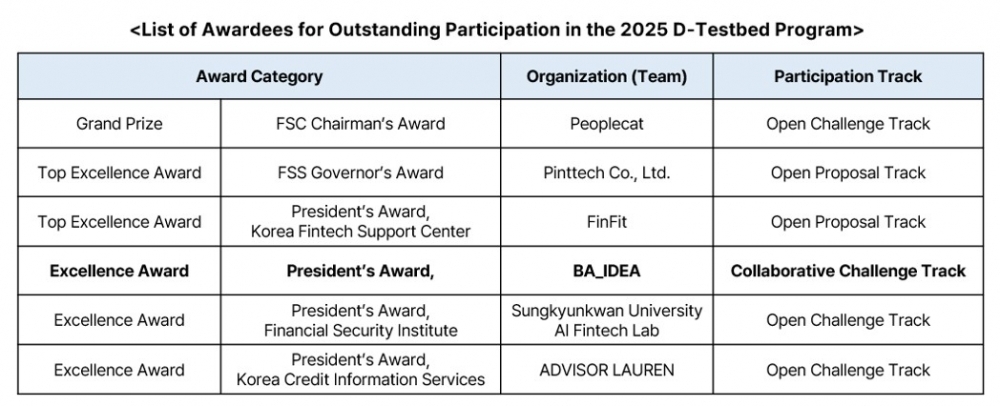

The Financial Services Commission (FSC) and the Fintech Center Korea, in collaboration with the Financial Supervisory Service, the Korea Financial Telecommunications & Clearings Institute (KFTC), the Financial Security Institute, and the Korea Credit Information Services, held the “2025 D-Testbed Outstanding Participant Awards Ceremony and On-site Roundtable” on December 23. The event was held to recognize six teams that achieved outstanding results through their participation in the D-Testbed program over the past year, and to gather feedback and suggestions from participating teams to help inform the future operation of the program.

The D-Testbed is a support program that provides financial and non-financial data and analytical environments to enable fintech startups and prospective entrepreneurs to validate innovative ideas prior to full-scale commercialization. In 2025, a total of 40 teams participated in the program across the first and second halves of the year. In addition, an “AI Specialized Track” was newly introduced in 2025 to support the development and advancement of artificial intelligence by providing high-performance computing resources (GPUs). A total of 10 teams participated in this track, undertaking proof-of-concept projects on highly complex tasks such as the development of MyData-based AI agents and the advancement of AI-based financial fraud detection.

Beginning in 2025, institutional and technical frameworks were established to allow participating teams to bring portions of their own data into the testbed environment for testing and validation. As a result, teams developing alternative credit scoring models were able to combine their proprietary data with data provided by the D-Testbed to conduct more comprehensive validation, thereby expanding the scope of data utilization. Through this approach, participating teams successfully enhanced the accuracy of their alternative credit scoring models.

In this context, the BA_IDEA team—comprising Kim Jong-hwan, Jung Hye-yoon, and Lee Dong-hoon from the 6th cohort of the Business Analytics (BA) major at Korea University Business School, under the supervision of Professor Baeho Kim—won the KFTC President’s Award (Excellence) for developing a “Personalized Loan Demand Forecasting Model.” Outstanding teams were selected based on a comprehensive evaluation of criteria including task feasibility, effectiveness of results, consumer benefits, and level of detail. A total of six teams were selected, and awards including the FSC Chairman’s Award were presented.

The BA_IDEA team developed a multi-horizon loan demand forecasting model by progressively accumulating learning periods and distinguishing forecasting horizons from short-term to long-term. Through this approach, the team demonstrated that both model performance and the influence of individual variables varied depending on the forecasting horizon. In addition, the team constructed an extended model incorporating alternative data such as telecommunications usage and card spending and behavioral data, statistically verified improvements in predictive power, and estimated the expected economic effects from a marketing perspective. The team stated that they participated in the D-Testbed to test data-driven financial models in a real-world environment, building on research questions that originated from a course taught by Professor Baeho Kim.

Team leader Kim Jong-hwan commented, “Thanks to the invaluable guidance of Professor Baeho Kim and the close collaboration among our team members, we were able to achieve meaningful results.” He added, “The Business Analytics program at Korea University Business School enables students to develop quickly under the guidance of outstanding faculty, and provides access to diverse opportunities through its strong peer and alumni network. I hope many will take interest in and consider participating in the program.”

The organizers noted that the participating teams clearly demonstrated how advanced AI technologies, such as unstructured data analysis and machine learning, can be applied in real-world financial settings. For example, proof-of-concept projects included the detection of delinquent borrowers using network (graph) analysis, as well as the identification of potential voice phishing risks by combining transaction patterns with demographic data.

During the on-site roundtable following the awards ceremony, participating teams shared their experiences from the testing process and offered various suggestions for the further development of the program. The teams remarked, “Access to high-quality data that would be difficult for small and medium-sized startups to obtain independently was extremely helpful,” and expressed hope that the scope of data provision and infrastructure support, including cloud services and GPUs, would be further expanded.